Hyperliquid blockchain has proven that on-chain perpetual futures can scale without sacrificing speed. HIP 3 is the upgrade that extends this model to builders. For those trying to understand what HIP 3 is, it introduces builder-deployed perpetuals, allowing developers to launch their own perp markets directly on Hyperliquid’s core engine. Builders control market design and earn fees, while Hyperliquid continues to handle execution, margin, and settlement. Launched in October 2025, HIP 3 is already driving meaningful volume and open interest growth.

What Is HIP 3 on Hyperliquid?

HIP 3 (Hyperliquid Improvement Proposal 3) introduces builder-deployed perpetuals by letting a third party deploy a dedicated perp DEX on Hyperliquid blockchain’s core execution and settlement layer. A deployer provides stake and becomes responsible for the perp DEX they launch, including its market configuration and ongoing operations.

In HIP 3, each builder deployment is a perp DEX with its own margining, order books, and settings, while Hyperliquid continues to handle core execution.

How HIP 3 Builder Deployed Perpetuals Work

HIP 3 markets run through Hyperliquid blockchain’s core execution stack for matching, margining, liquidations, funding, and settlement. The deployer does not replace Hyperliquid execution. Instead, the deployer configures a perp DEX and its markets using the protocol’s deployer controls and market configuration actions.

Practically, this means traders interact with a HIP 3 perp like any other perp market. Still, market-level configuration and operational decisions sit with the deployer rather than being purely protocol-curated.

Deployment Rules and Deployer Stake Requirement

Deploying a HIP 3 perp DEX requires 500,000 HYPE staked on mainnet. After all perps in that perp DEX are halted, the deployer must maintain the stake requirement for at least 30 days.

The first three assets deployed in any perp DEX do not require auction participation. After that, additional assets require a Dutch auction that uses the same hyperparameters, including duration and minimum price, as the HIP 1 auction. HIP 3 auctions for additional assets are shared across all perp DEXs.

Hyperliquid’s HIP 1 auction parameters include a 31-hour Dutch auction duration and a minimum of 500 HYPE.

Assets, Margin Modes, and Market Design

Hyperliquid blockchain’s HIP 3 lets deployers define and operate perpetual markets, but the system places hard constraints on risk design. HIP 3 currently requires isolated only margin mode. Cross margin is planned for a future upgrade, but HIP 3 markets today should be described as isolated margin markets.

Oracle and pricing design are central to market safety. Deployer configuration choices directly affect funding, liquidations, and settlement behavior, so this section should emphasize oracle robustness and conservative parameter setting as a core risk control.

Builder Responsibilities and Ongoing Operations

HIP 3 gives builders control but also responsibility. HIP 3 shifts meaningful operational responsibility to the deployer. The deployer runs a perp DEX and must actively manage market configuration, oracle inputs, and risk parameters over time.

Fees in HIP 3 and Builder Fee Share

HIP 3 fees are designed to align builders with the protocol. HIP 3 deployers can capture fees from trading activity on their deployed markets. Hyperliquid’s fee model also supports “growth mode” for HIP 3 perps. When Hyperliquid enables growth mode for a HIP 3 perp, it cuts the protocol-side fees and the associated accounting (rebates, volume crediting, and L1 rate limit contributions) by 90%.

Deployers can set an additional fee share for HIP 3 markets. The setting ranges from 0 to 300% in normal mode, and from 0 to 100% in growth mode. If the deployer share goes above 100%, the protocol fee rises to match the deployer fee.

Settlement, Safety, and Slashing Risk: How Oversight Works?

HIP 3 perps use the same core execution and settlement system as other Hyperliquid perps, including funding and automatic liquidation logic. The accountability mechanism is deployer stake.

Validators can vote to slash a deployer’s stake, and that stake remains slashable even after the deployer starts unstaking, throughout the seven-day unstaking queue. When slashing occurs, the protocol burns the slashed HYPE rather than paying it out to users.

What Are HIP 3 DEXs?

A HIP 3 deployment is best described as a builder-run perp DEX that inherits Hyperliquid’s execution and settlement layer. Each HIP 3 perp DEX has its own margining, order books, and settings, while remaining compatible with Hyperliquid’s broader trading stack.

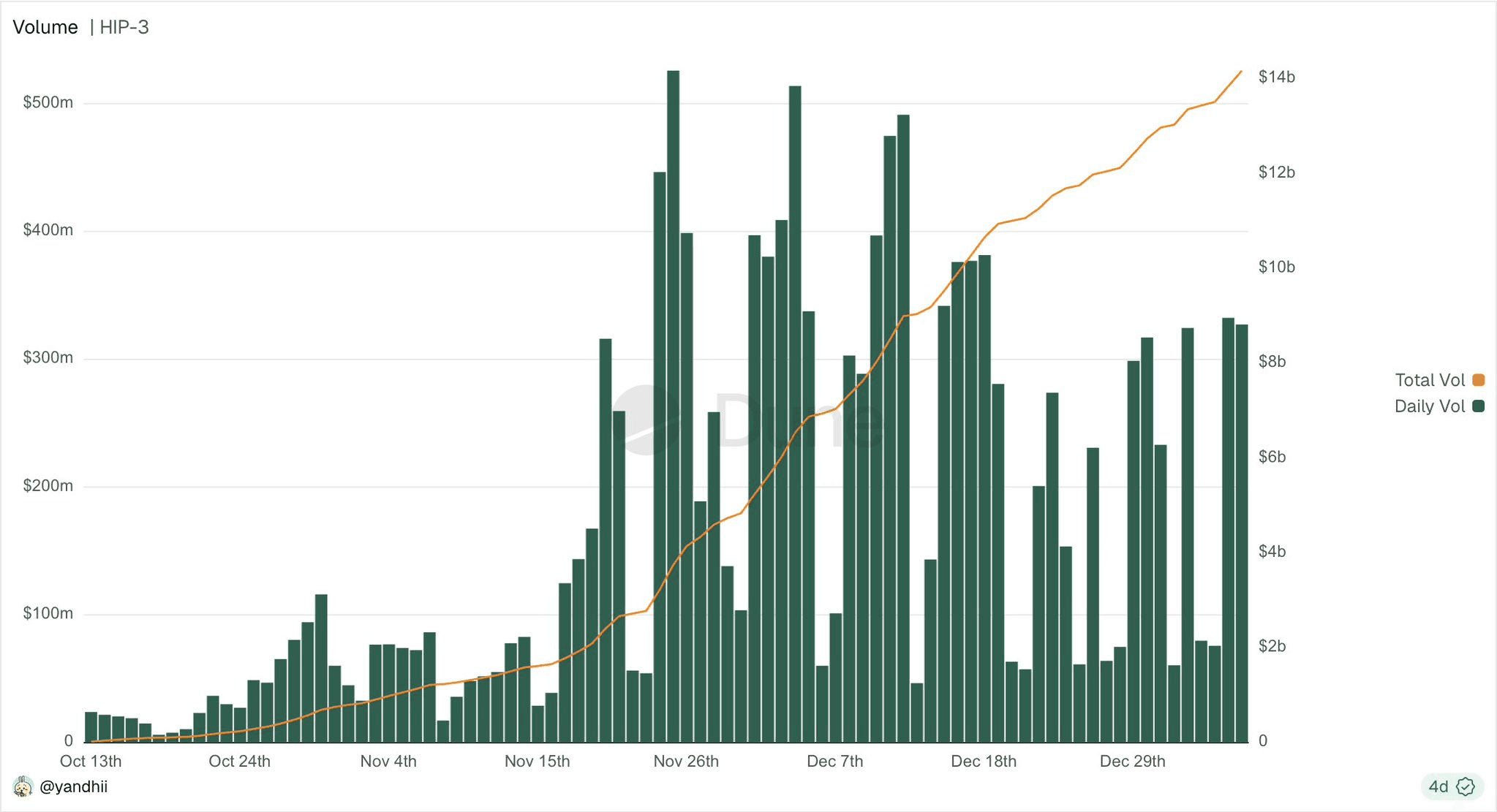

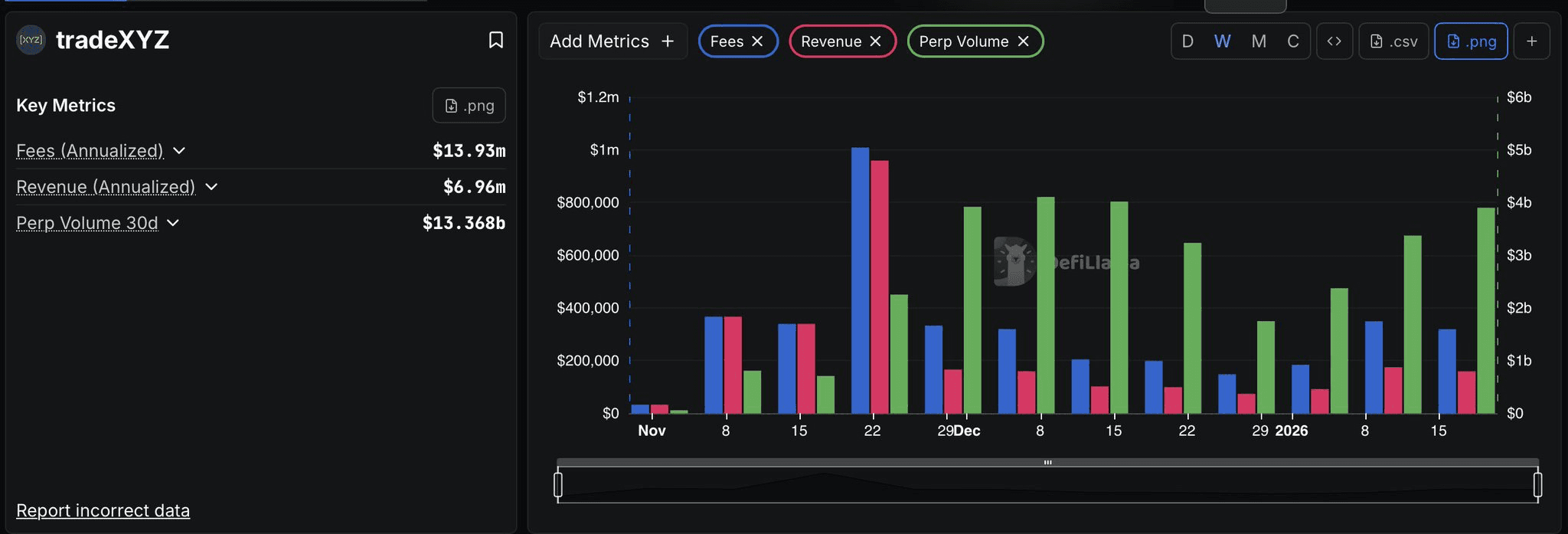

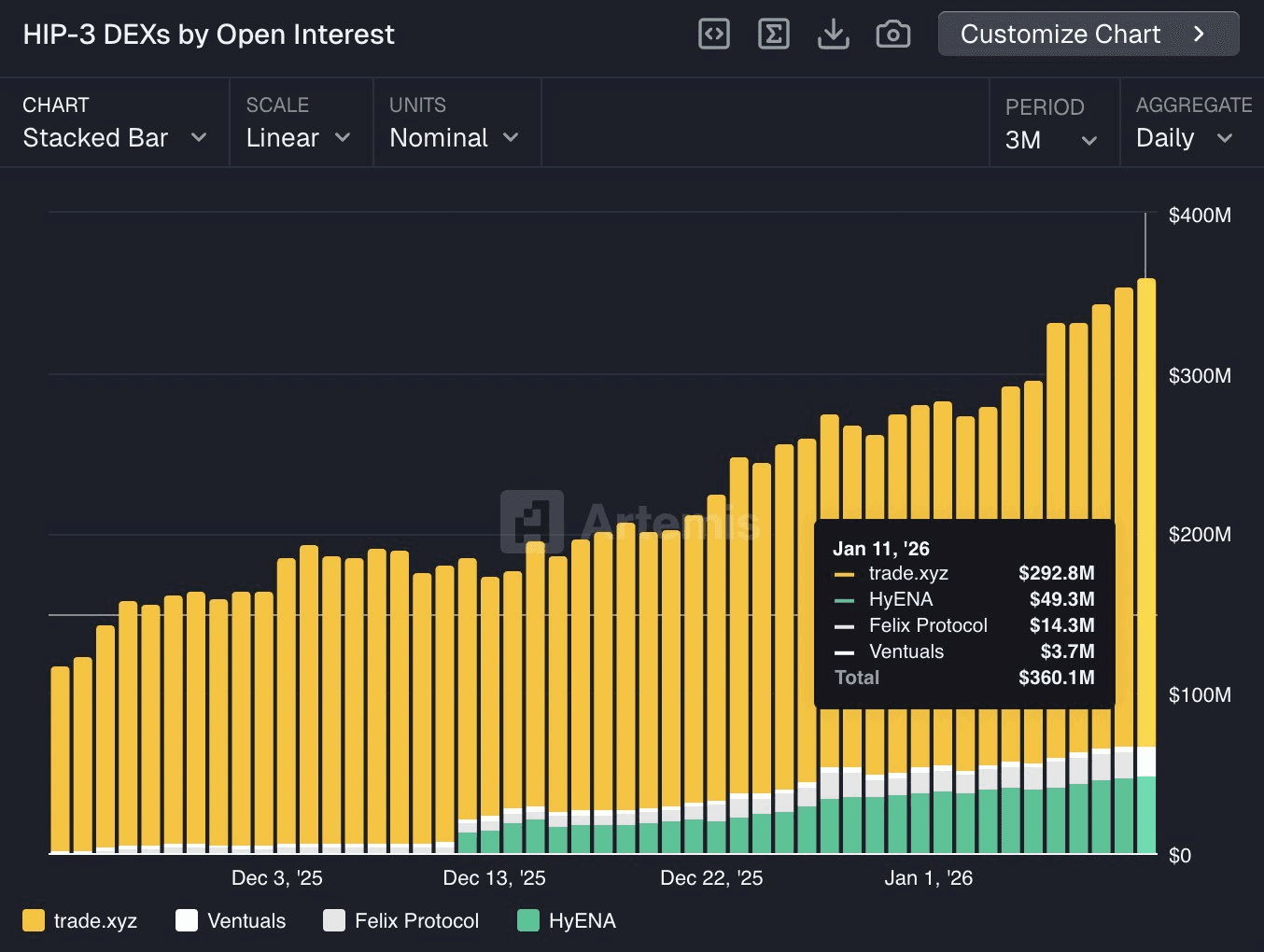

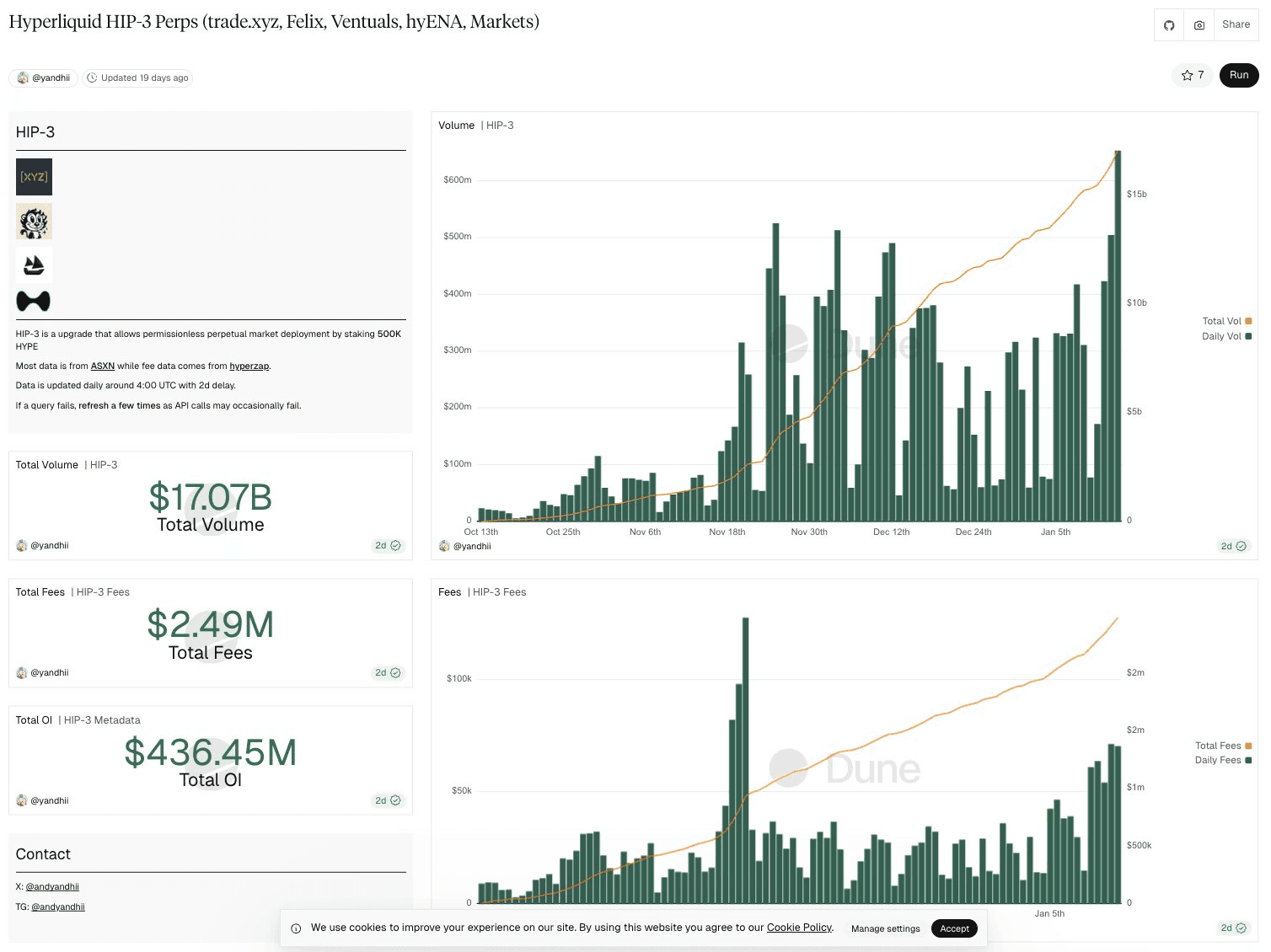

HIP 3 DEXs now cover equities, commodities, FX, RWAs, prediction markets, and crypto tail assets. Aggregated open interest has reached roughly $340 million, with recent peaks near $485 million.

HIP 3 currently accounts for about 4% of total Hyperliquid volume, with short-term spikes reaching much higher levels.

HIP 3 DEXs cover equities, commodities, FX, RWAs, prediction markets, and crypto tail assets.

Hyperliquid API, Info Endpoint, and HypeRPC: The Entire Stack

HIP 3 markets typically rely on the Hyperliquid API for data and operations. Builders and traders use it to query market data, monitor funding and liquidations, and track deployment auctions.

The info endpoint provides real-time data on markets, volume, and open interest.

For teams that do not want to run their own infrastructure, services like HypeRPC offer managed access and developer tooling tailored for Hyperliquid and HIP 3 use cases. APIs are the glue that connects builders, traders, and infrastructure.

Growth Outlook for HIP 3 and Hyperliquid

HIP 3 extends Hyperliquid blockchain’s market surface area by enabling builders to deploy perp DEXs while Hyperliquid maintains the execution layer. Near-term growth depends on deployers shipping strong market design, liquidity, and distribution rather than on protocol permissioning.

On the margining side, portfolio margin is a major system upgrade that already includes all HIP 3 DEXs. Hyperliquid describes portfolio margin as pre-alpha, with conservative caps, where only USDC is borrowable, and HYPE is the only collateral asset today.

So Is HIP 3 a HIT or a Miss?

So, what is HIP 3 in practical terms? It is Hyperliquid opening its core engine to builders. It enables builder-deployed perpetuals, supports the rise of HIP 3 DEXs, and shifts ownership from validators to deployers with real capital at risk.

Builders gain control and fee share. Traders gain access to more markets. Hyperliquid gains scale without central bottlenecks. HIP 3 is no longer experimental. It is becoming a core pillar of Hyperliquid’s growth into 2026.

1. What is HIP 3 on Hyperliquid?

HIP 3 is Hyperliquid Improvement Proposal 3 that introduces builder-deployed perpetuals by letting a third party deploy a dedicated perp DEX on Hyperliquid blockchain’s core execution and settlement layer.

2. How do HIP 3 builder-deployed perpetuals work?

HIP 3 markets run through Hyperliquid’s core execution stack for matching, margining, liquidations, funding, and settlement, while the deployer configures the perp DEX and its markets using the protocol’s deployer controls and market configuration actions.

3. What is the deployer stake requirement for HIP 3?

Deploying a HIP 3 perp DEX requires 500,000 HYPE staked on mainnet, and after all perps in that perp DEX are halted, the deployer must maintain the stake requirement for at least 30 days.

4. How do HIP 3 deployment auctions work?

The first three assets deployed in any perp DEX do not require auction participation, and additional assets use a Dutch auction with the same hyperparameters as the HIP 1 auction, including a 31-hour duration and a 500 HYPE minimum.